Additional SLFCU Services

LEARN MORE ABOUT ATM TRANSACTIONS

Your SLFCU Debit Card has no monthly fee, is accepted anywhere you see the Mastercard® logo at more than 30,000 CO-OP ATMs.

- Get Cash and Avoid ATM Surcharges

An SLFCU Debit Card provides easy access to cash at ATMs worldwide. Bank-owned ATMs typically impose a surcharge of $1.50 and up per transaction. To avoid those charges, always try to use a CU Anytime or CO-OP ATM. - Here's a Money-Saving Tip.

Your SLFCU Debit Card is honored for cash back at many retail stores that accept Mastercard Credit Cards, all over the world, with no surcharge. - How Many Transactions with No Service Charge?

When your card is attached to an SLFCU Quick Cash Checking Account, you get 20 free cash withdrawals per month. Thereafter, 50 cents per transaction at CU Anytime and 75 cents per transaction at other ATMs. When your card is attached to an SLFCU interest-earning Money Manager checking account you get 10 withdrawals with no service charge each month. Thereafter, 50 cents per transaction at CU Anytime, 75 cents per transaction at other ATMs. - Making Deposits

Many CU Anytime ATMs are equipped to accept deposits. Deposits made at a CU Anytime ATM before 1 pm Monday through Friday will post to your account later on that same business day. Deposits made after 1 pm Monday through Friday will post on the following business day. Friday deposits made after 1 pm will post on the following Monday, except federal holidays.

CASHIER'S CHECKS AND MONEY ORDERS

Cashier's checks and money orders are available for a nominal charge and can be used when you don't want to write a personal check. Cashier's checks may be obtained in branches, by sending a secure message within online banking, or by calling SLFCU at 505.293.0500 or 800.947.5328. Money orders are available in branches only.

COIN MACHINES

Coin machines are available at all SLFCU branches. There is no charge for members to convert coin to cash or deposit it into your SLFCU account. Some coin machines are not available for self-service; check with a representative if you don’t see a coin machine in the lobby of your branch.

LOAN PAYMENT COUPON

Print your own loan payment coupons.

Please note: this is a PDF file with fillable form fields. If the file opens in your browser window you may not be able to fill in the fields. You may need to open it in a different program, such as Acrobat Reader (available as a free download from https://get.adobe.com/reader).

INSTRUCTIONS

You will first need to select your loan type from the drop-down, then enter your payment amount and loan information into the appropriate fields. After your information has been filled out, you can print multiple copies which you may submit with your payment to SLFCU for reference purposes.

NOTARY SERVICES

Notary services are available to members at no charge; no appointment is necessary. If your document requires a witness, please bring one; SLFCU cannot guarantee that a witness will be available. You and your witness must have valid IDs, and all documents must be signed in the presence of the notary. Learn more about Signature Medallion Guarantees (PDF) and what documents you will need to bring. Learn more about The Signature Validation Program (PDF) and what documents you will need to bring.

ORDER YOUR CHECKS IN ONLINE BANKING

It’s quick and easy to order checks through SLFCU’s online banking. Here’s a quick guide to walk you through the process:

-

Log in to online banking.

-

Navigate to Checking Services under the “More” menu at the top of the screen.

-

Click Order Checks.

-

A new window will open with your account information auto-populated into the check ordering form. Click Continue.

-

You will be prompted to verify your name and address. Click Submit to be taken to the check ordering website where you can select your preferred check style, quantity, and preferred shipping method.

You can also use Checking Services to view your order status and order history. If you need assistance or you haven’t enrolled in online banking, you can also stop by any SLFCU branch to place a check order.

SAFE DEPOSIT BOXES

Please call for information about available boxes. Rental fees are deducted from your SLFCU checking or savings account annually in January. The rental fee is pro-rated for the number of months remaining in the year in which you begin renting a safe deposit box.

| Dimensions | Annual Rental |

| 2"x5"x21" | $15.00 |

| 3"x5"x21" | $19.00 |

| 5"x5"x21" | $26.00 |

| 3"x10"x21" | $31.00 |

| 5"x10"x21" | $43.00 |

| 7"x10"x21" | $48.00 |

| 10"x10"x21" | $75.00 |

LEARN MORE ABOUT SHARED BRANCHING

Shared branching is a cooperative network of credit unions, including SLFCU, that have joined together and created shared service centers across the country. By sharing facilities, SLFCU can offer greater convenience for you to access your accounts at many locations just as if you were at your home branch. Use our locator to find shared branching locations.

Members can enter any shared service center and conduct a range of transaction services, such as:

- Cash checks

- Make deposits and withdrawals

- Make loan payments

- Make transfers between accounts

- Purchase Money Orders and Official Checks

- Obtain cash advances and balance inquiries

To take advantage of this service, when you enter a shared branch you only need to bring:

- Your home credit union's name

- Your account number

- Photo identification

WIRE TRANSFERS

Incoming Wires

There is no cost for wire transfers sent to SLFCU from another institution. To receive a domestic or international wire transfer into an SLFCU account, you will need to provide the originating institution with the following information:

Receiving Institution:

- Sandia Laboratory Federal Credit Union

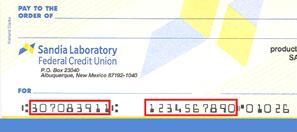

- Routing number 307083911 (shown below)

- SLFCU is not an international financial institution, therefore we do not have a SWIFT code. If asked, provide SLFCU's routing number instead: 307083911.

- Beneficiary Name (member or joint member’s name must match the account information)

- Account number with type and suffix (the 10-digit number at the bottom of your personal checks; shown below)

Outgoing Wires

There is a fee for this service. Applicable wire transfer fees will be assessed from the SLFCU account from which the funds are withdrawn. Refer to SLFCU's fee schedule for current information.

Wire transfers are processed based on the information you provide. SLFCU is not responsible for any liability arising from your request. Refer to Wire Transfer Terms & Conditions for more information. Domestic wire requests received after 1:30 pm MT and International wire requests received after 1 pm MT will be processed the following business day.

Please obtain specific wire instructions from the receiving institution. Do not use account information from the bottom of a check since institutions can use a separate routing number for wire transactions. To process an outgoing domestic or international wire transfer you will need to provide SLFCU with the following information.

Domestic Wire

- Receiving Institution Name

- ABA# (9 digits starting with 1, 2 or 3)

- Beneficiary Name and Address

- Beneficiary Account Number

International Wire

- Receiving Institution Name Country Swift Code (8-11 alphanumeric)

- IBAN (International Bank Account Number)

- Beneficiary name and address

- Beneficiary Account Number