Deposit Your Tax Refund

When setting up a direct deposit for your tax refund in SLFCU online or mobile banking, it’s important that the account number you use for direct deposit services is in a specific format. Please use the following information to set up your deposit:

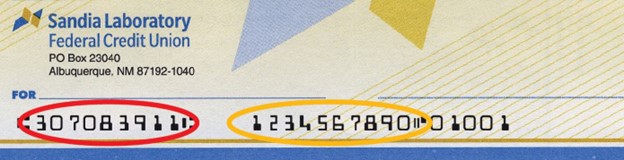

SLFCU’s routing number: 307083911

To deposit your refund into a savings account, use the account number and the product ID for that account. For example, if your savings account number is 1234567, and you would like the deposit to go to your 0002 savings account, enter your account number as 12345670002.

To deposit your refund into a checking account, use the account number and the product ID for that account. To locate that number, select Accounts from the top menu bar in online banking and click on the checking account for which you’d like to set up the direct deposit. Then, select the Account Details tab and look for the “Auto WD & Direct Deposit #” option.

You can also use the number printed on the bottom of your checks as shown in the image below. The automatic withdrawal and direct deposit account numbers are in the yellow circle in the bottom middle of the check. Note: the last number string – 01001 – in the image is the number for that individual paper check and should not be included with the account number. SLFCU’s routing number is shown in the red circle.

IMPORTANT DETAILS ABOUT TAX REFUNDS

- When setting up a direct deposit for your tax return, specify if the account is savings or checking.

- All named recipients on the refund check must be owners or joint owners of the specified SLFCU account. A person who is not a joint owner of the account cannot deposit their refund check into your SLFCU account.

If you need help with your tax refund direct deposit, call us at 505.293.0500 or 800.947.5328.

« Return to "View All Articles"